Other important initiatives against FATCA #

Petition by JR - French (the first petition) #

JR’s Petition 1088/2016

Contends that FATCA IGAs infringe on our rights as enshrined in the European Convention on Human Rights (ECHR) and that FATCA violates articles 8, 13 and 14 in particular as well as the principle of proportionality. See JR’s >petition here.

JR was invited on four occasions so far to the European Parliament to present his petition and comment on the follow up or lack thereof.

- The first time JR presented his petition at the European Parliament was >on July 11th 2017: JR’s presentation lasts the first ten minutes of the whole 24 minute meeting. It also includes meaningless interventions by 3 people representing the Commission. The Commission message is best summed up by Sophie in ’t Veld whose synopsis is truly admirable and easy to understand for all European citizens except the Commission it seems.

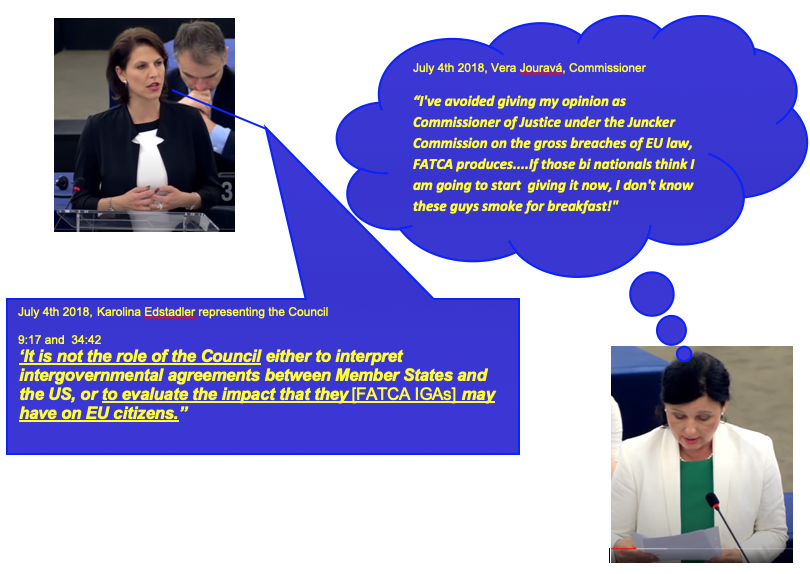

- The European Parliament voted at an overwhelming majority of 470 votes the motion for a resolution acknowledging JR’s Petition after ECON, LIBE and JURI agreed with the main points of his petition. See debate at the European Parliament >on July 4th 2018 (37 minutes).

- Special attention at 21:20 “the rights of EU-citizens” by Sophie in ‘t Veld.

- Commissioner Vera Jouravá 10:56 to 15:00 not addressing the issue of discrimination in EU regulated documents once.

JR’s petition provoked several meetings at the European Parliament to discuss the effects of FATCA as well the European Parliament commissioning a report and voting a resolution at an overwhelming majority.

The second time JR presented his petition follow up on the total inertia of the Commission since he had submitted his petition two years before >on February 20th 2019 (JR from 0:46 to 13:20 out of 40 minutes of discussion):

- Thomas Neale of the Commission 13:36 to 16:50 not addressing the issue of discrimination in EU regulated documents once and/or the true meaning of EU citizenship but goes on about the Payment Accounts directive.

- Nicolo Brignoli of the Commission 16:50 to 19:52 addressed the issue of discrimination to say there is none in the way the Payment Accounts Directive is implemented by Member States, but does not mention it in EU regulated documents creating the Capital Markets Union and which are at the center of our petition.

- The third time JR presented the advances or lack thereof pursuant to his petition >on November 12th 2019 (10 out of 120 minutes of discussion).

- The discussion on FATCA starts around 10:33

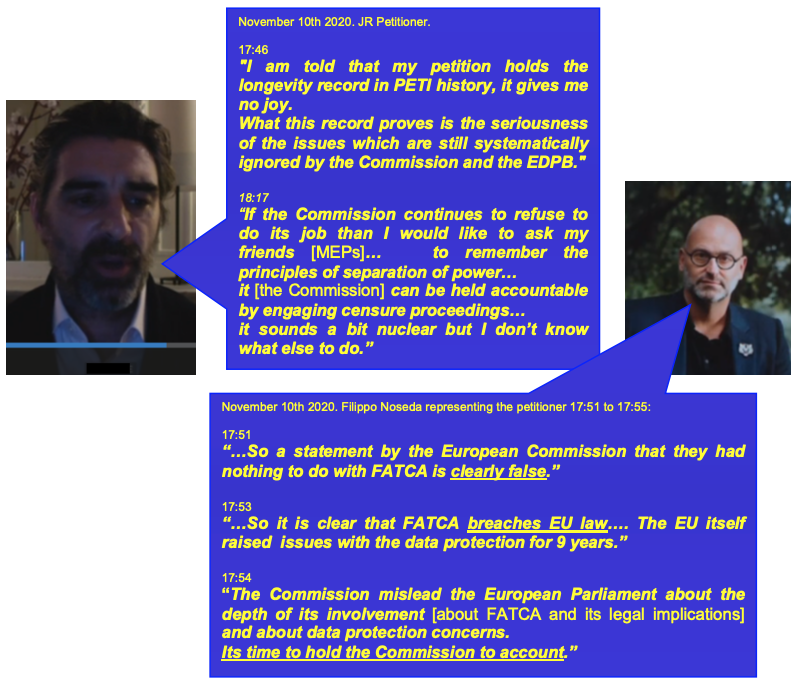

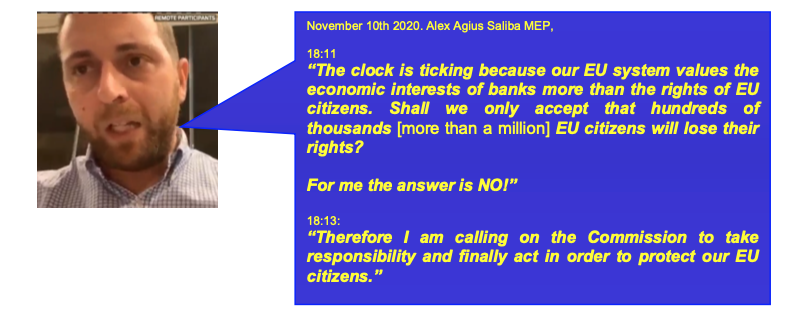

- The fourth time JR presented again the advances or lack thereof pursuant to his petition >on November 10, 2020 (35 minutes of discussion).

- The discussion on FATCA starts around 17:44 and runs until 18:20

- In his second intervention (18:15) he suggests that before the gross dereliction of duty of the Commission it raises the possibility of a petition requesting the EP to vote a motion of censure against the Commission.

In a very rare move, PETI has not closed JR’s petition in five and a half years because the European Parliament knows the FATCA issue is unresolved on several legal and political grounds.

The Commission favors big companies and in spite of the Repeal of the Privacy Shield turns a blind eye to widespread discrimination in the financial and banking industry and the fact that FATCA totally empties the EU citizenship of its meaning since bi nationals are being reported as US citizens by Member States' governments and European financial companies to the IRS.

Professor Garbarino’s presentation of PETI mandated report on FATCA can be seen here >presentation at EU parliament on May 17, 2018 (17 minutes). >His report sets clearly out the problems caused by the application of FATCA on the tax residents of EU Member States.

Please sign JR’s >petition 1088/2016 here as well our petition >petition 0323/2021 here.

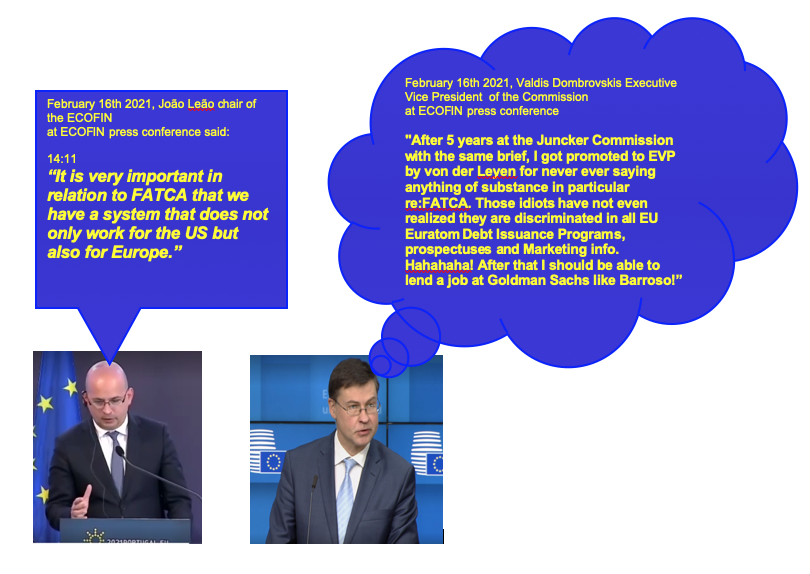

On February 16th 2021 FATCA was on the agenda of ECOFIN at the request of the Dutch government. After that meeting there was a >press conference with answers to FATCA questions:

Jenny’s (US born British citizen) complaint to the British ICO pre-Brexit #

Quoted from her page: “Under FATCA, banks are required to send all of my personal and financial information – and that of all those like me - to US authorities on an annual basis.

I am bringing a claim against HMRC for sharing my personal and financial information with the IRS because:

- The sharing of all my personal and financial information is a violation of my fundamental human rights to privacy and data protection. My information is irrelevant to the objective of FATCA which is to collect tax from those evading it. I am not liable for tax under FATCA as I earn less than the $104,000 income tax exemption for Americans living abroad.

- The sharing of my personal and financial information is in direct breach of GDPR.

- This sharing of my personal and financial information with the US government exposes me and countless others to a potential hack throughout the data processing chain (bank, HMRC, IRS).

- There is the significant unintended consequence that other US-born British citizens like me are unable to open local bank accounts, or are seeing them be closed down, due to the cost implications on banks of compliance with FATCA.

Nobody should evade tax. My problem is not with FATCA’s objective but the disproportionate nature of the measure to achieve its objective.”

You can support the >crowd funding from Jenny’s litigation in the (UK) to protect the fundamental rights of Accidental Americans and other compliant US citizens living abroad.

Developments of Jenny’s case can also be followed on >UK accidendal American FB page

Filippo Noseda #

Filippo Noseda is a lawyer and partner at Mishcon de Reya and Jenny’s legal counsel in the litigation against de British ICO for automatically exchanging her private information with the US IRS. He is also one of Europe’s top experts on the GDPR, Common Reporting Standard (thereafter CRS) and FATCA and is lead counsel in various lawsuits and complaints about FATCA and the CRS in particular.

Filippo Noseda is leading a formidable charge on FATCA and the EDPB and in a very unusual move has made his correspondence with both the EDPB and the ICO available for everyone to read on the internet. >Correspondence (mishcon.com)

Filippo Noseda spoke at the European Parliament >on November 12, 2019 at 11:49 to 12:00 proving that the Commission had serious misgivings about the compatibility of FATCA an EU law as early as 2010. The whole meeting lasted 120 minutes.

Filippo Noseda also spoke twice briefly >on November 10, 2020 in the European Parliament: The debate on FATCA starts around 17:45 and Filippo Noseda starts at 17:48. The whole meeting lasted 35 minutes.

- In his first intervention (17:48) Filippo Noseda shows that the Commission was aware of the incompatibility of FATCA (directive 95/46 that became the GDPR in May 2018) with EU law as early as 2010 and then “suddenly” pretended FATCA was not its responsibility.

- In his second intervention (18:20) he reminds us sternly that Commissioners lying to elected MEPs is against the rule of law.

Mishcon de Reya’s hacking list #

This list was prepared to support Jenny’s claim that FATCA illegally exposes her sensitive personal and financial data to the risk of hacking. The EDPB’s position was not modified in spite of the CJEU’s repeal of the Privacy Shield and the reasons it gave for it. In another case, the UK tax authorities acknowledged that the incidents reported by Mishcon de Reya were ‘serious’, but refused to stop automatically exchanging information with a non member state.

The list includes multiple instances of hacking against tax authorities in the US, the UK and the rest of the EU, including a hacking against Bulgaria that led to the theft of the entire database of the local tax authorities (between 5 and 7 million citizens affected). More recent incidents concerning the National Supercomputer and even the European Parliament confirm the fundamental problem of data security.

>A list with more than 80 pages, with 259 hacks and growing

The Dutch Accidental Americans Group (NLAA) #

The Dutch Accidental Group and other European allies, was created in 2018. Its goals are:

- by merging with other Europeans to write this petition and together monitor at the European level the strict application of EU Treaties, the Charter and the directives and regulations that constitute the framework of the Capitol Markets Union.

- to represent the interests of Dutch Accidental Americans at the Dutch Government level and through the Dutch Parliament.

- to fight against banks mandatory request for a Social Security Number (SSN / TIN) from its bi national clients to keep their accounts open.

- to obtain from the United States’ administration a Certificate of Loss of Nationality (CLN) without back filing for six years with the IRS (income tax, exit tax and FBARs) in a swift and inexpensive way.

>https://accidentalamericans.nl

L’Association des Américains Accidentels (the AAA) #

L’Association des Américains Accidentels was created in 2017. Its aim is:

- to represent the interests of French Accidental Americans at the French Government level and through the French Parliament.

- to represent and defend Franco-American dual citizens who live outside the United States from the adverse effects of American extraterritorial laws.

- the AAA’s priority is to fight the application in France of the Foreign Account Tax Compliance Act (FATCA) and the principle of Citizenship-Based Taxation (CBT), which is taxation based on citizenship instead of the country of residence.

- in particular, the AAA defends the interests of persons who hold American citizenship without ever having benefited from it and feel they belong exclusively to France and Europe.

- the AAA has been or is engaged in various legal actions in French, the United States, Belgium and Luxembourg.

>https://www.americains-accidentels.fr

Petition RA - Dutch #

In 2020 the Volksbank (Dutch bank) closed the accounts of accidental American RA. RA went to court but lost his case. The judge stated that he understood the problems of RA and all other Accidental Americans but that the solution had to come from the government.

That’s why RA started this petition. “I hereby request your help to prevent my fundamental right to have a bank account from being violated”.

RA has started proceeding in court for this. You can support the >crowd funding from RA (NL) to protect the fundamental rights of Accidental Americans and other compliant US citizens living abroad.

Petition number >1470/2020

RA has presented his petition to the EU PETI commission at Sept 2nd. See >PETI meeting at; 13:59 (presentation 5 minutes) and 14:36:30 (conclusion 2 minutes).

Petition Nicholas Lee (American) #

Summary title: On exemption of US nationals from PRIIPS regulations due to FATCA

The petitioner denounces that due to the applicability of the extraterritorial “Foreign Account Tax Compliance Act” (FATCA) it is difficult for “US Persons”, resident in European Union Member States to obtain access to numerous financial services or products. He points out that this situation is specially problematic in the context of MIFID II (Market in Financial Instruments Directive II) and PRIIPs (Packaged Retail and Insurance-based Investment Products) regulations that require all investment products sold to EU residents to contain a “Key Information Document”, which, as he explains, to date no US domiciled funds have provided.

Due to the lack of funds compliant with EU regulations, most US brokers refuse to sell responsible and safe investment products to a known EU resident. The petitioner calls on the European Parliament to permit US-based brokers to sell publicly traded and SEC-regulated investment products to EU residents, provided that they meet the definition of a “US person” under FATCA, as an exception to MIFID II / PRIIPs rules.

Petition number >0394/2021

Nicholas Lee has presented his petition to the EU PETI commission at Sept 2nd. See >PETI meeting at; 14:05 (presentation 5 minutes) and 14:39 (conclusion 2 minutes).

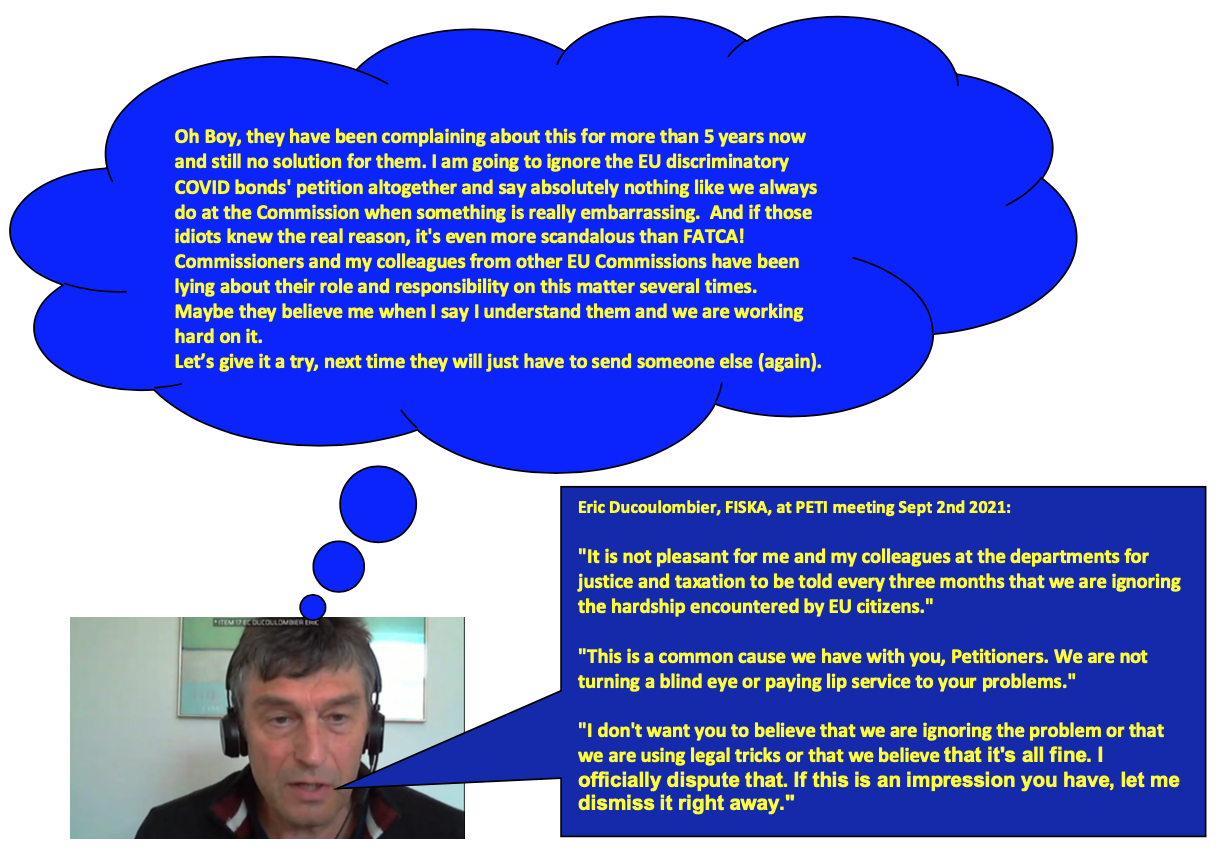

Eric Ducoulombier presented the EU commissions reaction to the 3 petitions presented on Sept 2nd 2021. See >PETI meeting at; 14:10 (presentation 10 minutes) and 14:41:30 (conclusion 3 minutes).

The Australian initiative #

“The mission of Let’s Fix the Australia/US Tax Treaty! is to press for amendments to the Australia/US Tax Treaty and the FATCA IGA to eliminate discrimination against a subclass of Australian citizens that is also disadvantageous to all Australians. We plan to gather the voices of those impacted, including Australian-only family members, and highlight the obligation of the Australian Government to defend its sovereignty and protect Australians against US extraterritorial law.”

The Canadian initiative #

ADCS stands for the ‘The Alliance for the Defense of Canadian Sovereignty’, a non-profit corporation registered in Canada. The purpose of ADCS is to defend Canada’s sovereignty and its people from the attempt of other countries to impose their legislation on Canada.

Their lawsuit was originally filed on August 11th , 2014 in a Canadian Federal Court. They asked the Federal Court of Canada to kill the FATCA agreement between Canada and the United States that rounds up innocent Canadians and turns them over to a foreign government. See the original >Claims submitted by the Plaintiffs. The Claims describe some of the laws they believe are violated by the FATCA agreement.

see: >ADCS | Alliance for the Defence of Canadian Sovereignty (adcs-adsc.ca)

The lawsuit is currently to be argued in the Federal Court of Appeal. To follow the suit’s status see: >http://isaacbrocksociety.ca

This site is remarkable for its sheer amount of information since many Canadians are dual citizens.

The Isaac Brock Society consists of individuals who are concerned about the treatment by the United States government of US persons who live in Canada and abroad. This Canadian group has started a legal action to prove that FATCA is against the Canadian Charter of Rights and Freedoms.

An American initiative #

“Association of Americans Resident Overseas (AARO’s) purpose is to create and maintain ties among American citizens located in and/or residents of countries other than the United States, with no regard for their political preferences or party affiliations, in order to:

- Unite their efforts to promote, assert, obtain and safeguard their social, civil and fiscal rights under US law.

- Undertake all actions, through all legal means, regarding the recognition of those rights of which they may find themselves deprived due to their absence from the United States.

- Educate and inform (i) overseas Americans of their rights and responsibilities as American citizens and (ii) the American Federal and state governments about the nature of the American population abroad and about their needs and views.”

>AARO - Association of Americans Resident Overseas

Keith Redmond #

Keith Redmond has very early on coordinated efforts between French, Canadians and many American organizations including congress to combat Citizenship Based Taxation.

“The American Expatriates group is for those who fully support an end to extraterritorial American taxation adversely affecting many populations outside the US. The US must cease imposing its tax code outside the US on tax residents of other countries.”

SEAT #

“SEAT is an independent, nonpartisan organization with no affiliation with the tax compliance industry. The mission of SEAT is to provide an educational platform for: individuals, politicians, governments, academics and professionals about terrible effects of US extraterritorial taxation. The imposition of US taxation on the residents of other countries damages the lives of the affected individuals, and siphons capital from the economies of other nations while eroding their sovereignty.”

Monte Silver #

A bi national Israeli US lawyer who has been repeatedly suing the US government against GILTI. It is a tax that applies to US owned businesses abroad but it is particularly penalizing for small businesses that are treated like major multinational corporations from a tax standpoint.

“This group is focused exclusively on the battle of American small businesses against the abuses they have suffered and continue to suffer at the hands of the U.S. Congress and the Treasury/IRS.

A private person who is saying “Enough is Enough!”